Taxation in General: Hungarian Tax System

Taxation of the income from employment

Tartalomjegyzék

- Taxation in general: Hungarian Tax System

- COPYRIGHT PAGE

- I. Chapter. First things first

- II. Chapter. Social security system – social solidarity

- III. Chapter. Personal Income Taxation

- IV. Chapter. Calculation of the personal income tax and contributions for earned income

- V. Chapter. Certain defined benefits, fringe benefits (cafeteria), separate taxable income

- VI. Chapter. Corporate tax: double taxation or the social expenditure of the enterprises

- VII. Chapter. Hungarian Tax reform 1988-2020

- VIII. Chapter. Value Added Tax

- Rudiments of sales taxes

- Main principles and peculiarities of the VAT system

- The Hungarian VAT system

- VAT subject (Tax client)

- Basis of assessment

- Scope of those liable to pay VAT and reverse taxation

- Exemptions from VAT

- Genuinely VAT exempt transactions

- Tax rates in VAT

- Special methods for establishing VAT

- Taxation of travel agencies (tour operators) based on their margins

- Small rural producers – compensation surcharge

- Secondhand trading – taxation based on the difference

- Rudiments of sales taxes

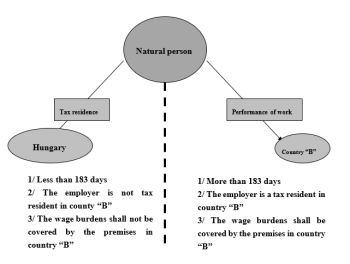

- IX. Chapter. Fundamental principles of international taxation, structure of the model agreements taxation of salaries

- Summary

- References

Kiadó: Akadémiai Kiadó

Online megjelenés éve: 2022

ISBN: 978 963 664 137 5

Taxation is a scheme for the state to provide revenue. The so collected money could then cover the public spending of the government. These are the so-called allocative and redistributive functions of the state budget. Although, taxation theory discusses the various tax types and analyses the various taxation tools very extensively, there is no absolute answer to the question, when and what type of taxation system would be optimal. Thus this introductory book on taxation deals with the three basic types of taxes - the income tax, the VAT and the corporation tax - in a very pragmatic way. There are legal texts and cases from both the international and also from the relevant Hungarian practice. This book is recommended not only for students of economics but also for law students and practitioners beside anyone who is interested in the basic regulations of taxation.

Hivatkozás: https://mersz.hu/lakatos-taxation-in-general-hungarian-tax-system//

BibTeXEndNoteMendeleyZotero